It’s not the sort of sales pitch you associate with luxury brands. The acronym BOGOF might pass muster in the aisles of Tesco, but you won’t find it in Harrods, oh dearie me, no.

But if it’s luxury flats in London you’re after, it’s a different story.

It seems they’ve built so many of these chrome and glass white elephants that they can’t give the things away.

The one area of the housing market with too much supply

Ages ago in Money Morning, my colleague Dominic Frisby pointed out that new-build property in London – specifically at the luxury end – was almost certainly going to turn out to be an appalling investment idea.

He was quite right.

Judith Evans reports in the Financial Times, that in the second quarter of 2018, almost 40% of London new-build sales were to “bulk buyers”.

And of course, when you buy anything in bulk, you get a discount. Apparently (according to analysts at Molior London), 10%-15% off is “quite normal” and 20%-30% is rare but achievable.

Why is this happening? There are lots of factors involved, but they all boil down to that old equation: supply and demand.

For a while, amid the turmoil of the credit crunch and its aftermath, luxury property in global cities practically became an asset class of its own. We could maybe call it the “bolthole” asset class.

Rich people, from all over the world, were looking for reasonably safe assets (with the bonus potential for a bit of yield), in jurisdictions where they could have a reasonable amount of faith that their property would not be confiscated.

The credit crunch is one thing, but the flight to global luxury property was driven more by the resultant political turmoil. Remember the Arab Spring? The eurozone crisis? Capital flight from both Russia and China? A lot of wealth was under threat. And as a result, a lot of that wealth found its way to London (and Manhattan and Toronto and the rest).

On top of that, there was plain old cheap-money-funded demand for property to flip. Plenty of Asian investors in particular liked the idea of paying a deposit on an off-plan, and then flipping the property at a later date, usually before it had even been built, to someone willing to pay a higher price. It’s almost like spread betting on residential flats.

OK. So we can see that there was a lot of added demand there. But we can probably also see that this demand had a certain lifespan to it.

Yet builders responded to it. The number of new luxury housing units under construction is, even now, at an all-time high.

And when they couldn’t build enough property in genuine prime locations, the builders started to move outwards. That’s why you’ll see these constant attempts to stretch the notion of “prime” to areas of London that even I, an almost entirely disinterested non-Londoner, could tell you are anything but.

So we’ve got supply booming in response to rising prices. It’s exactly the same story as your typical resources cycle. Prices rise, so producers start producing more.

But – as with mining – there’s a long lag between starting building and finishing, and during that time, things can change.

Which they did.

A crackdown on rich foreigners

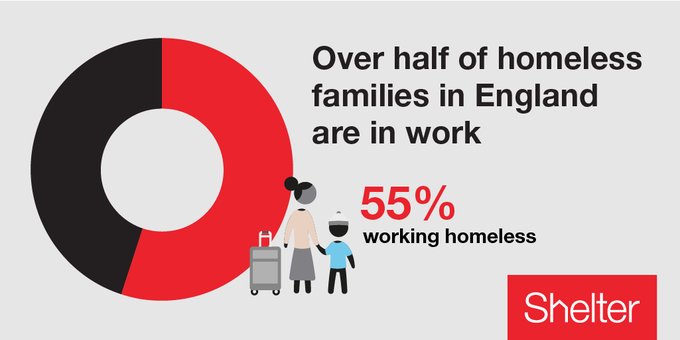

“Normal” people around the world cannot afford to buy property in their capital cities. This situation is particularly bad in London, but London is by no means unique.

This lack of affordability has very little to do with rich foreigners. Rich foreigners are effectively a separate market. The likes of you and I could never and probably will never be able to afford to buy the properties that rich foreigners trade in.

Instead, the general lack of affordability afflicting the UK market (and plenty of others) is primarily the result of low interest rates. It’s been exacerbated by various government interventions in the market to prop prices up (apparently “Help to Buy” is now the “only game in town” for individuals buying in outer London, note Molior in the FT. Best of luck selling those properties on in the future, folks).

However. If your population is fed up with something, then blaming rich foreigners is always a good political option. They stick out like a sore thumb because they leave their ugly luxury skyscrapers lying around empty all over the place, and no one will complain about discrimination, because after all, they’re rich and they deserve it.

So George Osborne, back when he was merely chancellor rather than a fellow hack, jacked up stamp duty on expensive homes and made the tax environment much more hostile to overseas buyers.

Cue demand drying up.

The point is, once house builders and developers have built this stuff, they want to get it off their books. If they can’t sell it at full price, they’ll have a clearance sale.

They won’t make as much money as they hoped to, but as long as they don’t sell at an outright loss, then most of the time it’ll make sense to take the hit and move on, rather than bear the carrying costs of unsold stock.

This will get worse before it gets better

However, what’s more interesting is what happens when the people who loaned the money to fund these projects start to panic.

According to one un-named analyst in the FT piece, many of these sales have been pushed through by lenders who want to “protect loans to developers.” And as more such sales are made, the desire to get out of the market fast will only pick up. You go from “let’s sit tight and ride out the storm” to “we need a fire sale!” overnight.

Throw in an environment of rising interest rates, and things could get very interesting indeed.

I still suspect that this will be largely confined to a rarified part of the market (although I’d have to get a better idea of the extent of bank exposure before I’d be sure on that).

And I wouldn’t expect to be able to pick up any bargains any time soon. I mean, sure, there’s a price at which a beige and glass box in a mediocre part of an over-rated city represents good value, but it’s a long way down from here.

But the good news is that the wider end of the market is slowing in any case. According to the Office for National Statistics, UK house prices are now rising at their slowest rates since May 2013, and in “real” (inflation-adjusted) terms are flat.

Hopefully that will continue. And in the meantime, keep an eye on the crash at the “luxury” end as developers and lenders scramble to save their backsides from the usual boom and bust cycle.

Source: Money Week